Mobile Payment Options Preferred By Chinese Tourists

As mobile technology continues to advance in China, it’s no surprise that mobile payment has become an integral part of daily life for many people. With digital wallets like Alipay and WeChat Pay, traditional payment methods such as cash and bank cards are gradually being phased out. This trend is not limited to domestic transactions, as Chinese tourists abroad also prefer to make payments through their mobile devices due to security concerns.

In this blog post, we will explore popular mobile payment systems among Chinese tourists, advantages for both consumers and businesses, case studies of successful integration, challenges that may arise during implementation and future trends in this ever-changing landscape. Stay tuned!

Popular Mobile Payment Systems Among Chinese Tourists

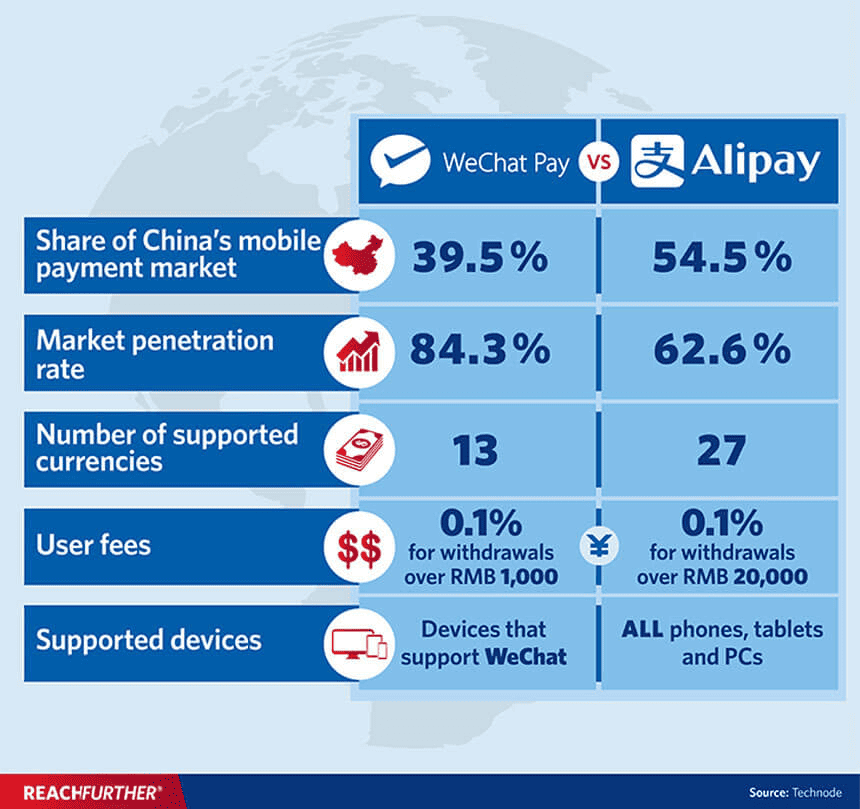

WeChat Pay and Alipay are the two best mobile payment apps among Chinese tourists, with WeChat Pay being a more social-based platform that includes messaging, while Alipay focuses on financial services.

Detailed Overview Of WeChat Pay And Alipay

WeChat Pay and Alipay are two of the most popular mobile payment app among Chinese tourists, allowing for quick and convenient transactions both domestically and internationally.

WeChat Pay has become a popular payment option in China by integrating with the widely-used WeChat social media platform and partnering with businesses across various industries. It has a user base that consists of 90% of adult internet users in China.

Other payment options like Alipay have also collaborated with popular services like Didi Chuxing for the convenience of consumers, while WeChat Pay has teamed up with JD.com, one of China’s leading e-commerce players.

Mobile wallet services include also apps like Google Pay, Apple Pay, and Samsung Pay.

Third-party payment platforms can expand their services to cater to Chinese tourists who prefer familiar transaction methods while traveling abroad.

Other Emerging Mobile Payment Platforms

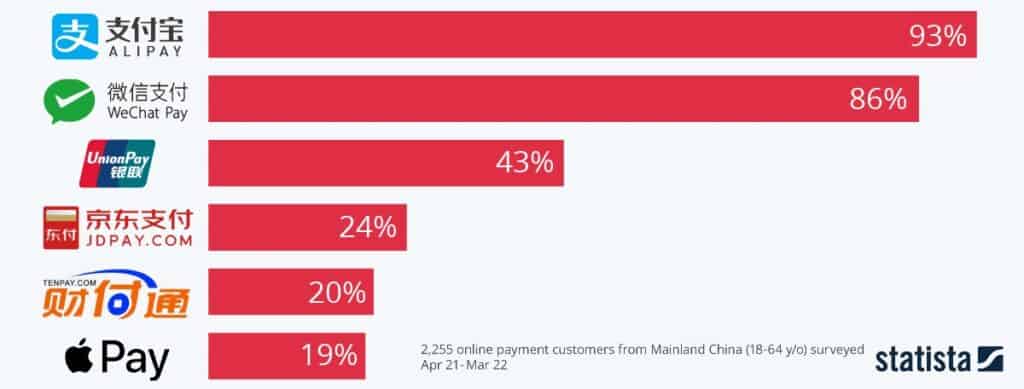

While Alipay and WeChat Pay currently dominate the market, there are other emerging platforms worth considering.

There are three notable digital payment platforms in China.

JD Pay offers seamless integration with online marketplaces, Baidu Wallet is a comprehensive digital wallet solution leveraging its parent company’s search engine dominance, and UnionPay QuickPass is gaining traction in the online payment market due to its wide acceptability as an extension of China’s leading card network.

Features That Make These Systems Popular

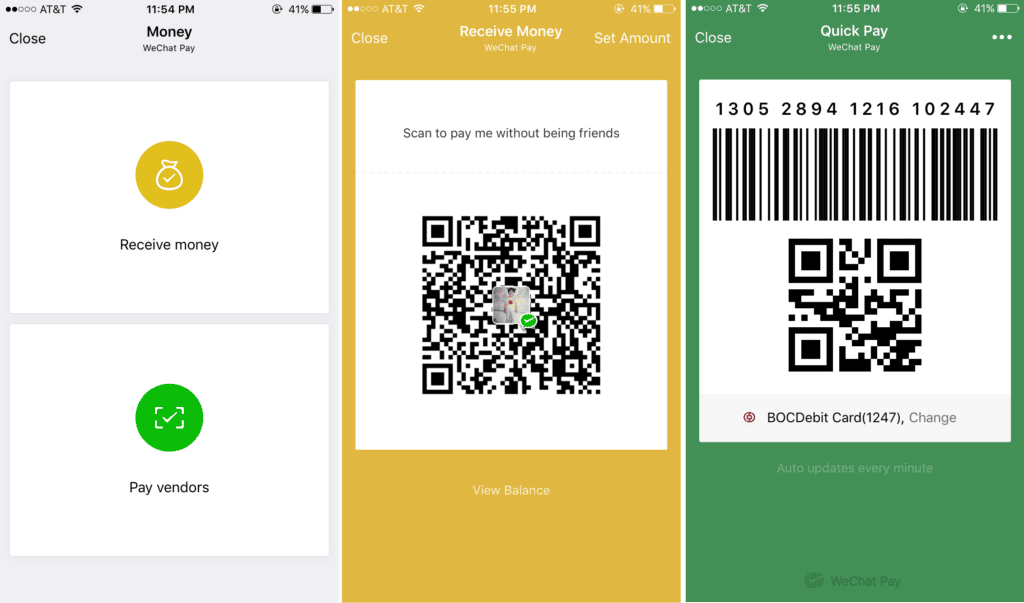

These systems have features that make them popular among users, including their convenient and easy-to-use interfaces, customized promotions and discounts, enhanced security measures, and integration with popular platforms such as WeChat.

For instance, some merchants offer QR codes for payments directly from within the WeChat app itself.

Moreover: According to Nielsen and Alipay’s survey in 2018-19, nearly 80% of urban Chinese shoppers use mobile payment services extensively for most of their purchases which shows that consumer behavior has shifted towards digital mediums.

Advantages Of Mobile Payment Systems For Chinese Tourists

Mobile payment systems offer enhanced security measures, ensuring that Chinese tourists can securely make cashless transactions while traveling abroad.

Enhanced Security Measures

Enhanced security measures are one significant advantage of mobile payment systems for Chinese tourists.

Chinese tourists prefer mobile payments over other payment methods because of the added security features like facial recognition and fingerprint scanning.

Mobile payment platforms like Alipay and WeChat Pay also offer transaction notifications and anti-fraud measures, which further increase their trust in these payment options.

This increased trust can lead to higher customer satisfaction and loyalty toward businesses that accept mobile payments.

Convenient And Easy-to-use Interfaces

Chinese tourists prefer mobile payments due to their user-friendly interfaces and accessibility, making them the key to convenience in payment systems.

The convenience and speed of mobile payments are crucial in travel-related activities such as booking tours or paying for transportation.

Offering easy mobile payment methods can enhance customer satisfaction and increase revenue.

A survey by Nielsen on Chinese outbound tourism trends in 2018/2019 found that over 90% of respondents cited convenience and speed as their primary reasons for using mobile payments during travel.

Integration With Popular Platforms Like WeChat And Alipay

Integrating mobile payment systems with popular platforms like WeChat and Alipay can provide a significant advantage for businesses looking to attract Chinese tourists.

The platforms provide easy integration and user-friendly interfaces for making purchases while traveling abroad. Businesses can also gain valuable data on consumer behavior and preferences by integrating with these platforms.

For instance, businesses that integrate their loyalty programs with WeChat Pay can leverage this data to offer customized promotions and discounts tailored specifically toward Chinese travelers.

Customized Promotions And Discounts

The benefits of mobile payment systems for Chinese tourists are numerous, but one key advantage is the ability to provide tailored promotions and discounts through popular platforms such as Alipay and WeChat Pay.

These promotions can be tailored specifically to Chinese tourists’ spending habits and preferences based on their purchasing history within these apps.

These personalized incentives not only encourage Chinese tourists to use mobile payments but also enhance their overall shopping experience abroad.

Impact Of Mobile Payment Systems On The Tourism Industry

Mobile payment systems have had a significant impact on the tourism industry, with Chinese tourists spending more money and increasingly demanding mobile payment acceptance from merchants.

Increased Spending By Chinese Tourists

Chinese tourists are increasingly using mobile payment systems while traveling abroad, with over 90% of them preferring this method according to recent reports. This has led to a rise in both the proportion and amount spent.

Destinations that have implemented AliPay and WeChat Pay have seen a significant boost in their tourism industry revenue as these mobile technologies make purchasing a seamless process for Chinese spenders.

Growing Demand For Mobile Payment Acceptance By Merchants

There is a growing demand for mobile payment acceptance by merchants in the tourism industry.

In fact, many businesses have already implemented mobile payment systems to accommodate Chinese tourists’ preferences and increase sales.

For instance, hotels are now allowing guests to make payments through their preferred digital wallets such as Alipay or WeChat Pay.

China’s mobile payment transaction volumes have surpassed those of the United States, indicating the significance of mobile payments in China’s economy.

Merchants who do not offer contactless payment options risk losing revenue from international tourists who expect to use their phones for payments seamlessly.

Changes In Consumer Behavior And Expectations

Chinese tourists now prefer mobile payment systems that offer enhanced security measures, convenient interfaces, and customized promotions.

Traditional forms of payment are no longer sufficient. With mobile payments triggering consumers’ hedonic mindset, tourism businesses will need to adjust their offerings and market accordingly to attract these tourists.

Therefore, implementing mobile payment systems can not only improve user satisfaction but also increase spending by Chinese tourists on hedonic products such as luxury goods or experiences.

Case Studies Of Successful Integration Of Mobile Payment Systems

Explore real-life success stories of businesses that have successfully integrated mobile payment systems like Alipay and WeChat Pay to enhance their customer experience and grow their revenue.

Examples Of Businesses That Have Successfully Integrated These Systems

Here are some examples of businesses that have successfully integrated mobile payment systems for Chinese tourists.

Marriott Hotels has partnered with Alipay to offer guests the ability to pay via their mobile devices in select locations throughout Asia.

Even small businesses are embracing these payment solutions. A noodle shop in Tokyo started accepting WeChat Pay and saw an immediate increase in Chinese customers.

Lessons Learned And Best Practices

As the adoption of many payment apps continues to grow rapidly in China, businesses looking to attract Chinese tourists must understand the lessons learned and best practices for successful integration.

The success or failure of a mobile payment platform is influenced by cultural preferences and social norms.

To ensure success, it is important to make the platform easy to use and convenient for users, by integrating with popular platforms and offering customized promotions and discounts.

Successful integration requires consideration of regulatory, technical, and financial factors, as well as infrastructure availability and potential solutions for overcoming challenges while adhering to regulations

Challenges And Solutions In Implementing Mobile Payment Systems

Implementing mobile payment systems can be a daunting task for businesses due to regulatory considerations, technical challenges, and compatibility issues with existing systems.

Regulatory Considerations

Implementing mobile payment systems requires careful consideration of regulatory compliance. For instance, the People’s Bank of China (PBOC) introduced new regulations on mobile payments in 2018, which included stricter security and anti-fraud measures.

Businesses using mobile payments must comply with certain requirements that include integrating facial recognition for identity verification.

Cross-border transactions also require special attention due to different financial regulations in various countries.

To comply with these requirements, businesses should work closely with payment processing partners who possess a deep understanding of the local regulatory environment and can help guide them through complex compliance issues.

Technical Challenges

The challenge of implementing mobile payment systems for Chinese tourists is related to technical aspects such as security, the vulnerability of older mobile devices, fraud prevention, and criminal activity.

Older mobile devices with mPOS applications are more vulnerable to fraud and hacking, so businesses need to ensure adequate security measures such as encryption technologies and two-factor authentication.

Future Of Mobile Payment Systems For Chinese Tourists

Mobile payment adoption in China is expected to continue growing, with the development of new technologies such as blockchain and the potential introduction of a digital yuan likely to further accelerate this trend.

Continued Growth In Mobile Payment Adoption

The rise of mobile payment systems is causing businesses to adapt and provide these services to customers. Chinese tourists, in particular, prefer using mobile payments while traveling.

This shift offers benefits such as enhanced security measures that reduce fraud and a convenient method of payment for customers.

Additionally, these platforms are user-friendly and integrated with popular social media apps like WeChat and AliPay which allows merchants to offer customized promotions based on individual preferences – ultimately driving customer loyalty.

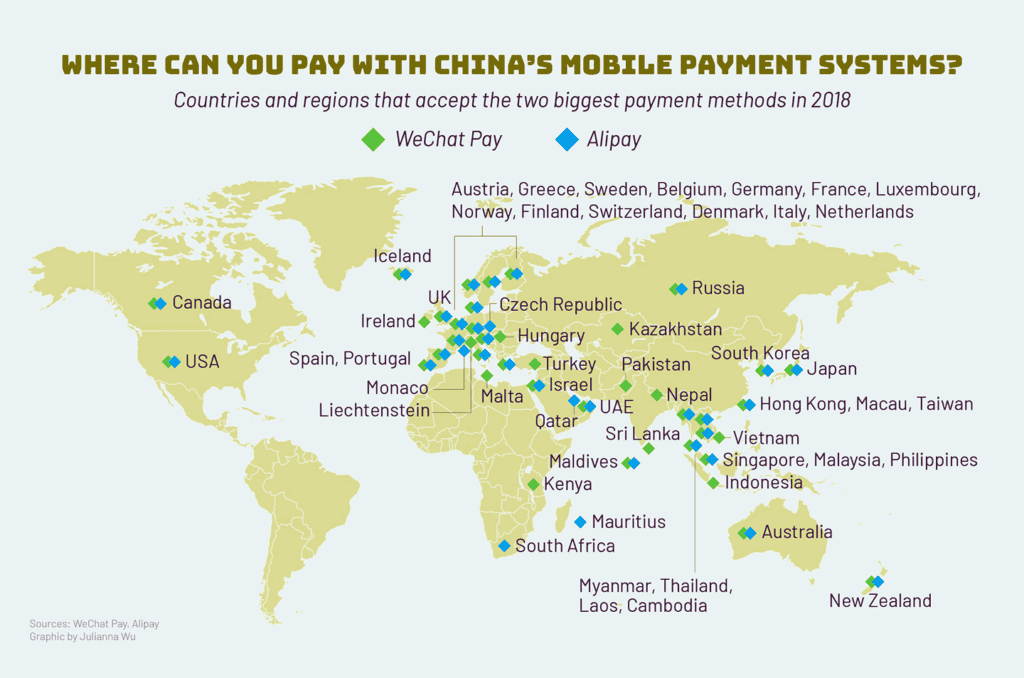

Expansion Of Mobile Payment Services Beyond China

Chinese mobile payment systems like Alipay and WeChat Pay are expanding rapidly across Asia and beyond, with over 20 million people outside China using Alipay for transactions such as shopping, dining, and hotel bookings.

This trend is driven by Chinese tourists who prefer using these familiar payment methods while traveling abroad, and it shows no signs of slowing down.

Potential Impact Of New Technologies

New technologies like blockchain and digital yuan are set to revolutionize the mobile payment landscape for Chinese tourists and have the potential to transform the global monetary system. The move towards cashless payments is expected to have far-reaching effects on financial transactions, user data privacy, and consumer behavior.

For example, China’s new digital currency – e-CNY could provide valuable financial transaction information that Beijing can use while being used by Chinese consumers.

We are your local partner in China!

Understanding the mobile payment preferences of Chinese tourists is crucial for businesses to capitalize on the trend of overseas spending.

WeChat Pay and Alipay are the most popular mobile payment systems used by these travelers, offering enhanced security measures, convenient interfaces, and customized promotions and discounts.

Tourism businesses should consider integrating these systems to increase sales and meet consumer expectations.

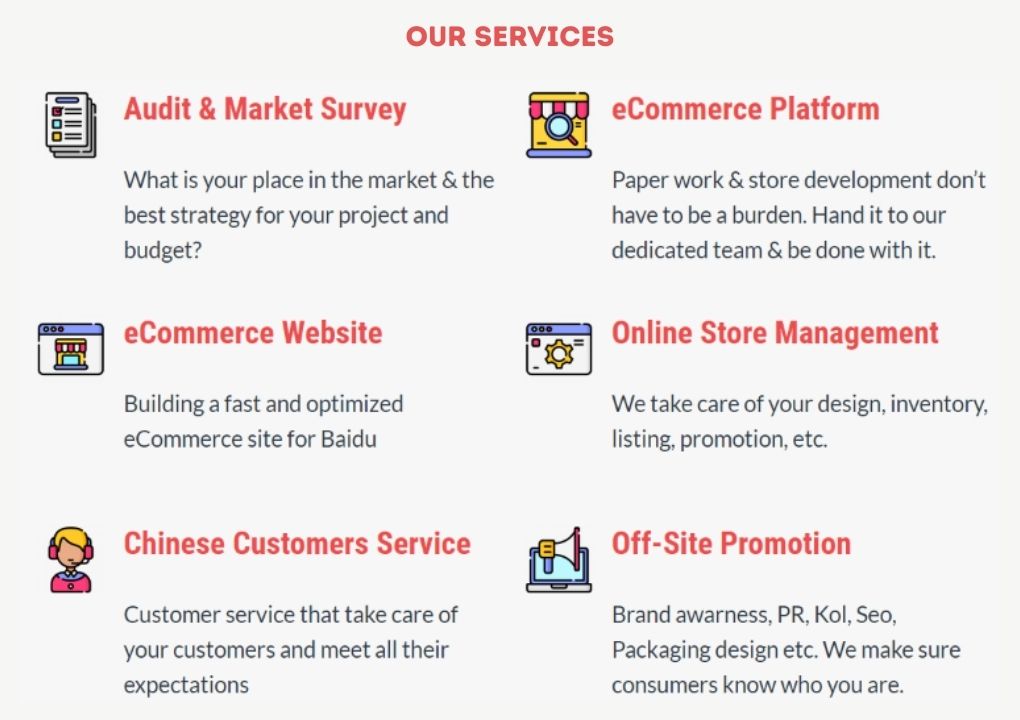

We are a China-based marketing agency offering cost-effective solutions to foreign brands interested in tapping into the Chinese market. Our team of Chinese and foreign experts has the experience and know-how needed to succeed in this lucrative, yet complicated market.

Gentlemen Marketing Agency offers many digital marketing and e-commerce solutions, such as web design, e-commerce and social media marketing strategies, localization, market research, KOL marketing, and more.

Don’t hesitate to leave us a comment or contact us, so that we can schedule a free consultation with one of our experts, that will learn about your brand and present you the best solutions for your China market strategy.