Chinese investors lose trust in China Real estate Market.

Chinese investors are searching new investment opportunities with oversea real estate stable investments.

China’s property developers began 2022 with low sales. Many real-estate firms struggled to rekindle home buyer interest despite goverement’s recent efforts to relax some restrictions.

Chinese Developers Drop in Sales in January 2022

Despite Beijing’s recent efforts to relax restrictions, real-estate companies struggle to rekindle their interest.

China’s housing market is slowing down from the hot gains it enjoyed in years past, but it is still thriving. In February, the average price of a new home rose 1.7% over the previous year and 1.2% in January.

However, financial filings, marketing materials, and property agents’ and analysts’ reports tell a completely different story. Debt-burdened developers sell apartments at falling prices, sometimes even offering huge discounts in order to get more cash.

Most Chinese residential real-estate developers have seen a sharp drop in their contracted sales since last summer. Many have also reported substantial drops in their average selling prices this past year. source

China’s housing market is slowing down in 2022

The Foundation of a Real-Estate Colossus was shaken by Beijing’s Debt Clampdown

The government’s efforts to ensure housing affordability for all will be tested by China Evergrande’s imminent collapse and ripple effects on the economy.

Country Garden Holdings Co., a Chinese financial giant, reported a 14% decrease in its average selling prices in January and February compared to the same months in 2021. Logan Group, a mid-sized developer, reported that its average selling price fell by 40% in the first two months 2022.

The property market has not yet shown a clear recovery. a Chinese business club member said that “the supply, demand, and prices are falling” in reference to homes.

China property developers under pressure

China property developers have been under severe pressure since the government placed restrictions on excessive borrowing in the summer 2020. Investors have dipped into their dollar bonds, pushing the average yields to over 30% and making it prohibitively expensive for developers to raise funds in debt markets. Many real-estate firms are selling apartments to avoid defaulting. Apartments are one of their largest sources of cash.

Soho China a developer of mixed use commercial and residential buildings, announced earlier this month that it would sell nine projects located in Beijing and Shanghai at 30% off and use the proceeds to repay its debts

According to online forums and property agents, Zhengzhou is the capital of Henan province in central China. Property developers are struggling to sell their homes, while many buyers remain untouched. Zhengzhou has become a major city thanks to rapid urbanization and industrialization over the past decade. Real-estate developers have flocked there in droves.

A Zhengzhou property agent named Li said that “people have lost faith”, referring to homebuyers. They are concerned that developers might not be able finish the construction and will therefore lose money. They are also concerned that prices will continue to drop.”

Market is going down : Discounts scare Chinese investors

To attract buyers, some developers offer huge discounts. An apartment listed by China Vanke Co., another stronger developer, was recently advertised on social media at a 19% discount. Local home buyers complained last month that similar discounts were being offered at a Country Garden project located in Zhengzhou. They claimed that this had a negative impact on the value of their apartments.

China Vanke is in critical situation in Chine. Country Garden stated that it had “adjusted some buildings prices in certain projects at times” in Zhengzhou based on the market and selling prices for neighboring projects and called it a standard promotional practice.

According to property analysts and economists, one reason that China’s official home-price data shows little change is its composition. The national index measures property prices in 70 of China’s 700 cities. Larger cities such as Beijing, Shanghai, Shenzhen and Shanghai have seen stronger price increases.

The average selling price reported by developers can be affected by their geographical coverage and when projects are launched.

Some analysts believe that the government’s home price data is also used to influence the market. Officials have an interest in smoothing the data out and keeping it stable. A drop in prices could cause people to be less interested in buying homes. This would make the market more difficult.

Chinese real estate investors are pessimistic about China, searching oversea

Last month in a newspaper column that January’s relatively stable home-price data aimed to pessimistic mood in the sector and prevent a downward trend of new-home prices. He noted that the government has sought to maintain stability in land- and home-price levels and that prices are steadily declining over the past year helps market expectations.

China began compiling its housing-price index around two decades ago. In 2005, the National Statistics Bureau created the list of 70 cities. Many other Chinese cities were still small villages. Analysts believe it does not reflect today’s real estate market.

Analysts say that the index focuses too heavily on cities with higher housing prices. The index does not include the cities that have experienced the largest price drops.

Most of these developers’ properties are located in lower third- and fourth-tier cities. China’s tier classification system relies on the city’s population, political leadership level, and economic growth.

Third- and fourth-tier municipalities are less economically and industrially strong and have lower demand for housing than first- and second-tier communities.

In tier-three and four cities, there are increasing numbers of unsold properties. The number of unsold homes has increased for almost 40 months, according to a report by Shanghai E-House Real Estate Research Institute.

According to Chinese state media, developers sometimes give away cars, parking spaces, decorations, or other household items to help them sell more apartments.

Logan Group, a large presence in southern China has promoted some of its properties there. One in Liuzhou is a third-tier Guangxi city that offers buyers incentives including discounts up to 20% on the property’s cost, five years of management fees, and a raffle for appliances.

A developer advertised in Xinyang (a third-tier Henan city) recently: “Buy a home and get a luxury vehicle.” Some buyers can purchase cars for 100,000 yuan. Others could get a Mercedes-Benz worth 300,000.

The Chinese government’s official index of property prices shows the general trend in China’s real estate market, with a few months lag, but does not reflect the magnitude and speed of price movements. This could be due to a variety of factors, including the sampling of housing units and projects by the city, government price control, hidden price adjustments made by developers with different incentives, or even price controls.

After signing a contract, either with a seller or a developer, home buyers must register their property with the local housing bureau to make a transaction legal. According to property agents and analysts, local statistics bureaus collect registered prices.

E-House China‘s real-estate service provider E-House China. He stated that price controls are a major reason why home-price data remains stable, while market-price fluctuations have been greater in both directions.

In order to limit property prices, mega cities such as Shenzhen and Shanghai, which have seen their property values rise the most, have implemented price limits and taxes. In recent months, some cities have also imposed minimum prices to prevent home prices falling further.

Analysts suspect that local housing bureaus may delay the registration for properties with very high or low prices to maintain stable data from month to month.

Chinese investors’ love for real estate properties

- Education for their kids

- Emmigration opportunities

- Take their cash out of China

- Stable investment

China has experienced tremendous volatility in the past few years when it comes to overseas property investment. China has a population of over 1.3 billion people. Its GDP grew by approximately 7%, and there is a huge potential market for overseas real estate investors. Investors seek better opportunities in terms work, environment, immigrant investments, and educational opportunities.

Aside from the fact that real estate prices in China are on the rise, Chinese investors are looking for better opportunities around the globe to purchase a property in another country.

Where Chinese investors are searching property investment ?

ONLINE

Lead generation in China for property.

China is a country where digital is the best way to generate leads. This is because China is one of the most internet-centric countries in the world, and it is also a place where investment is a common practice. It is no surprise that Chinese spend an average of 1.5 hours per day searching for information. The younger generation, which is tech-savvy, uses social media to share content with friends and family.

Promote your real estate agency online to Chinese investors

You probably know that online promotion is a must if you wish to attract Chinese investors. How do you do this?

Make a Chinese website : fondation

Your digital marketing approach should include a Chinese website. It is important to remember that most Chinese people don’t speak English fluently so they won’t be able to read websites written in simplified Chinese. This is also a key to your rank on Baidu search engine. No matter how well-respected you may be in the United States or elsewhere, China is virtually invisible to your company. The “great firewall” makes it impossible to access all your positive reviews.

It is important to have a Chinese website that is well-designed. This will allow potential investors to understand the company and the property you offer. You can optimize your website for smartphones and computer users if you are able. The majority of Chinese people use their smartphones to search online.

Your Chinese website need traffic

Backlinks to your website are a great way to increase traffic to your site and improve your ranking in search results. You should also keep in mind that not all overseas investors will have access to the property they invest in. It is important to present a broad range of asset profiles, with concise details, to help investors better understand what they are getting.

Another great way to view what you are providing is through video. You can also create high-quality videos from the properties of your video. Your website, videos, images and websites should all be translated well into mobile format. Most Chinese use their mobile phones for their web research. You can send the above-suggested content directly to investors by using IM on a WeChat profile.

Promotion in China, what you should understand

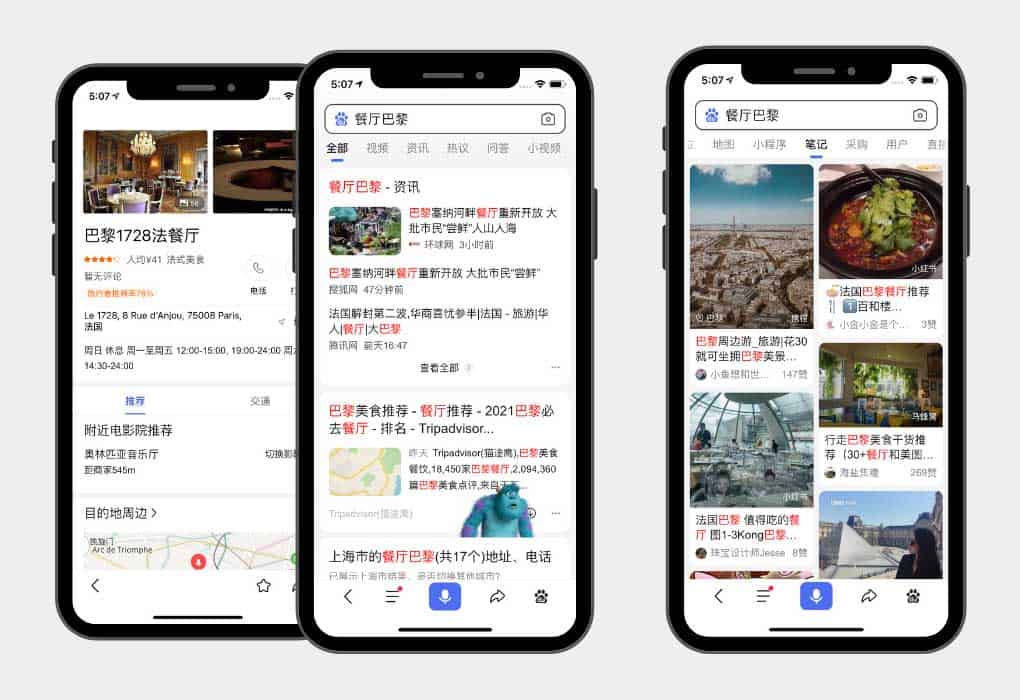

Baidu is the best way to sell your properties to Chinese investors

You must increase your website’s visibility after creating it. Baidu, the most used search engine in China and the 5th most visited website worldwide, is a crucial step to take if you are looking to sell real estate. Baidu is responsible for 75% of all investment and property research. To master Baidu you must first optimize your website to rank on the first results page of Baidu.

Baidu allows you to display and promote your company. Statistics show that you could lose up to 65% of your potential traffic if you don’t appear on the first search results page.

It is highly recommended that you do search engine optimization to get on the first page. Baidu will help you rank higher if you search for the right keywords. This Chinese website will serve as your “storefront desk” for China. PPC can also be a great complement to the ongoing search engine optimization by real estate companies. This will ensure you remain in the top spot for paid search results while real estate will still offer a great ROI. Combining these two methods works best for PPC. This was more important at the beginning of your market entry, but SEO has become more feasible after several months of active marketing.Your website will have to be optimized & audited on the ‘back end’ (meta tags/descriptions/titles, etc) for a most effective SEO (Search Engine Optimization).

You can find more information on Baidu in our complete guide Baidu SEO. If you have any questions or additional inquiries, please don’t hesitate to contact us.

Use social media to engage with clients

WeChat, the most used social media app in China is essential if you are looking to dominate the Chinese market. It is therefore important to be familiar with WeChat’s internal operations and promotion methods. Your audience will be able to contact you directly if they have an official WeChat profile. Potential investors will be able to view updates from your company and photos of your properties via your WeChat moments.

You can share any new properties on your official account, so your followers can instantly see them. WeChat is the best way to build a relationship with Chinese investors. WeChat is the first step towards conversion. You can access almost every website in China via QR code. Make sure to include your QR code in your WeChat account. Potential investors will be able to follow your official account directly.

WANT CHINESE INVESTORS?

WANT CONNECT WITH CHINESE REAL ESTATE AGENTS?

CONTACT US.