Chinese investors bullish on Indian real estate

India’s real estate : the new El Dorado for Chinese Investors ?

India has become the favourite country for realtors allowing of 100 per cent foreign direct investment (FDI) into the real estate industry.

A lot of projects in the industrial parks interest global investors and institutions who are taking note of the changing regulations in India, especially those relating to real estate investment trusts (REITs). REITs provide investors with an extremely liquid stake in real estate. They receive special tax considerations and typically offer high dividend yields.

India has around 200 million square feet of real estate space available and the Securities and Exchange Board of India (Sebi) proposed further relaxed norms for REITs. If the proposal is accepted, REITs will be able to invest up to 20% in under-construction projects compared with 10% currently allowed.

Foreign investments in India

Blackstone, Brookfield and JP Morgan are good examples, they already have a presence in India and are investing large sums of money in the Indian real estate.

But the interest from the powerful countries in Asia is growing more and more.

Chinese investments in India

The Indian real estate, an opportunity for Chinese

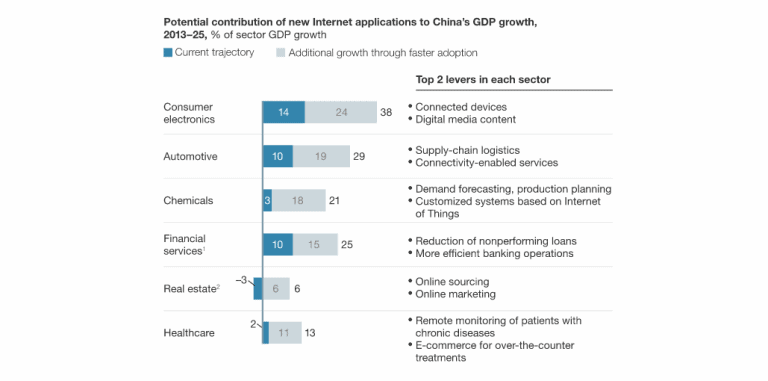

Nowadays China’s economy slowdowns a bit.

At the opposite, India is exploring a growth in its own economy.

That is why Chinese developers can get there an opportunity investing in the Indian real estate.

‘Wanda Industrial New City’

An memorandum of understanding (MoU) was signed between China Fortune Land Development (CFLD), one of China’s most prominent developers and Haryana state in North India.

The investment will reach 10 billion of dollars over a period of 10 years. It is one of the biggest investment done in India so far and is even bigger than most of the deals that Chinese companies did abroad.

This project is called ‘Wanda Industrial New City’. It will comprise 1,300 hectares including an industrial park that will house companies from various sectors such as software, automotive manufacturing, machinery, health care, education and other industries.

The construction is likely to start in 2016 and should be completed in the next three or five years.

Gezhouba’s investment

Gezhouba, another prominent Chinese construction company, has in-principle agreed to invest Rs 10,000 in irrigation projects in Telangana state, in the south of India.

Japanese investments in India

Japanese developers are particularly interested in industrial projects in India.

In that way, they are exploring strategic partnerships to enter into Indian joint ventures.

There is likely to be an inflow of at least $2 billion in investments from Japan into the Indian real estate market over the next three years.

Singapore investments in India

Temasek Holdings

The Singapore government-owned company is one of the largest investors in India, with a net investment portfolio of $9 billion. Last year, it invested $5 billion in India, which is the highest since the 2008 financial crisis

I invite the investors to Turkey to earn more than they think in the sectors of Tourism , tekstile , building

Omer Cansiz

ceo

Very nice information 🙂

My name is Mustafa Naveed Vohra and i am an 19 year old business entrepreneur. I had started my Real Estate brokerage two years from back and had been much successful in my business. I am planning to start my real estate investment and property management firm here in Pakistan as the Pakistani real estate is growing everyday at staggering rates. I look forward for Chinese Investors and Real estate leads from china through your marketing expertise.