China aims to establish a real estate fund with a total value of up to $44 billion for the suffering sector

Chinese property developers are in a severe financial situation, and a state bank official with intimate knowledge of the situation says the country will set up a fund to help them out. The fund would attempt to raise $300 billion yuan ($44 billion) in order to restore investor trust in the industry.

After months of speculation over the state’s ability to save the struggling real estate sector, the government has finally taken a huge step in the right direction.

China’s central bank, the People’s Bank of China (PBOC), has agreed to provide 80 billion yuan in initial funding for the fund, a source familiar with the situation tells Reuters.

There will be a 50 billion yuan contribution from China Construction Bank (601939.SS), which is owned by the Chinese government, but the money will come through PBOC’s refinancing facility.

Aiming to generate 200 to 300 billion yuan, more banks will follow suit if the strategy is successful, he said.

The housing market in China, the world’s second-largest economy, has been shaky and a big drag on economic growth in the past year. This month, homebuyers staged a revolt, adding to the authorities’ woes. The more you read, the better. In the opinion of some experts, a fund would only be a partial solution.

The property market in China, along with related industries such as construction, accounts for more than a quarter of the nation’s gross domestic product (GDP).

As part of the government’s effort to increase rental housing, the fund will be used to finance the acquisition of incomplete home projects, complete their construction, and then rent them to individuals, according to a source.

PROPERTY SHARES RALLY

China’s property market turmoil, including the debt crisis, credit tightening, and mortgage boycott, has eroded confidence in the industry and caused authorities to scramble to prevent issues from spreading to the wider economy.

“If the (fund) can be realized in the near future, it prevents additional developers from defaulting and improves market sentiment and developers’ sales,” said Raymond Cheng, the head of China research at CGS-CIMB Securities.

The most recent news sent the Hang Seng Mainland Properties Index (.HSMPI) up more than 5 percent on Monday morning, and it was up 3.5 percent by midafternoon. The CSI 300 Real Estate Index (.CSI000952) increased by nearly two percent.

Financial information provider REDD first reported details of the real estate fund on Monday.

The fund would support more than a dozen property developers, including embattled China Evergrande Group (3333.HK), REDD reported, citing unidentified sources.

Regulators and local governments would select the developers eligible for support from the fund, REDD said, adding that the fund could be used to buy financial products issued by the developers or finance state buyers’ acquisitions of their projects.

Beijing is also considering a national policy for issuance of special bonds for shantytown redevelopment, the report said.

The Real Estate crisis pushes Chinese to invest overseas

As Beijing tightens its grip at home to restore order, Chinese developers’ spending spree abroad comes to an end. This year, according to Real Capital Analytics, Chinese developers have invested $1,9 billion worldwide. Compared to the record-breaking $17.5 trillion in 2017.

Companies such as Guangzhou R&F Properties and Greenland Holdings continue to invest in Australia and the United Kingdom despite regulatory pressure.

This year, the leading investors in overseas properties were Chinese developers. As Beijing limits capital outflows and cuts risky borrowings to boost financial health, analysts believe that their investments will continue to decline.

Investment is not linked with tourism

Chinese businesses seek a secure and stable environment. During the first decade, Chinese investment in Europe was minimal, but 2010 data indicate a major growth.

According to a joint assessment by Baker and McKenzie and New York’s Rhodium Group, Chinese investments in Europe increased from US$ 6 billion (about S$ 8 billion) in 2010 to US$ 55 billion in 2014. Between 2014 and 2015, annual investment climbed from $18 billion to $23 billion. According to Bruegel, a Brussels-based economic think tank, Chinese outbound foreign direct investments (FDI) are distributed as follows: 13 % in Europe (stocks worth US$13,9 billion) and 13 % in North America (stocks worth US$11.4 trillion) have also been major recipients.

There are many risks in the wider Asian credit market

CreditSights reported that investors seeking diversification had pushed Asian credit valuations to the limit. Despite having solid fundamentals, many South and Southeast Asian names are not qualified for a market grade, according to the report.

The Chinese property dollar bonds have risen in recent sessions as a result of a number of policy moves to loosen constraints on the real estate industry and provide broader monetary stimulation. According to Goldman, the future remains murky, and additional defaults are expected.

Failures will not spiral out of control, which may sustain interest in other parts of the Asian market. However, any prolonged crisis could result in a global economic slump. Regional indices include a major portion of Chinese debt. Investors may choose to withdraw their funds entirely.

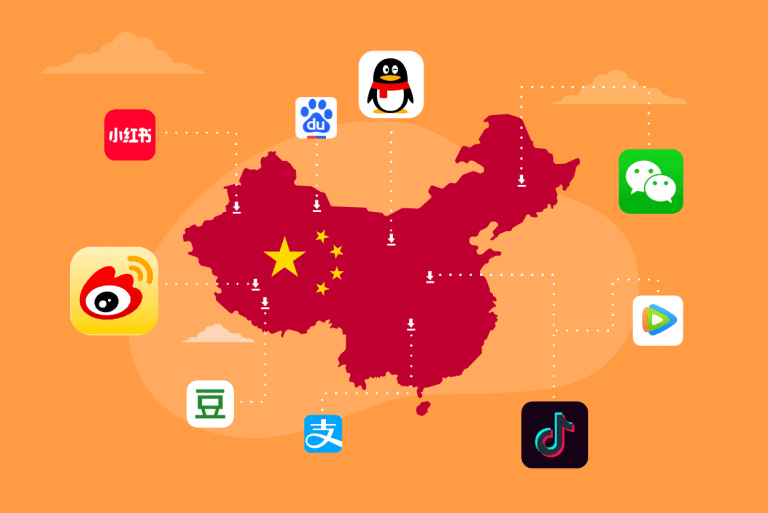

Do you want to attract Chinese investors?

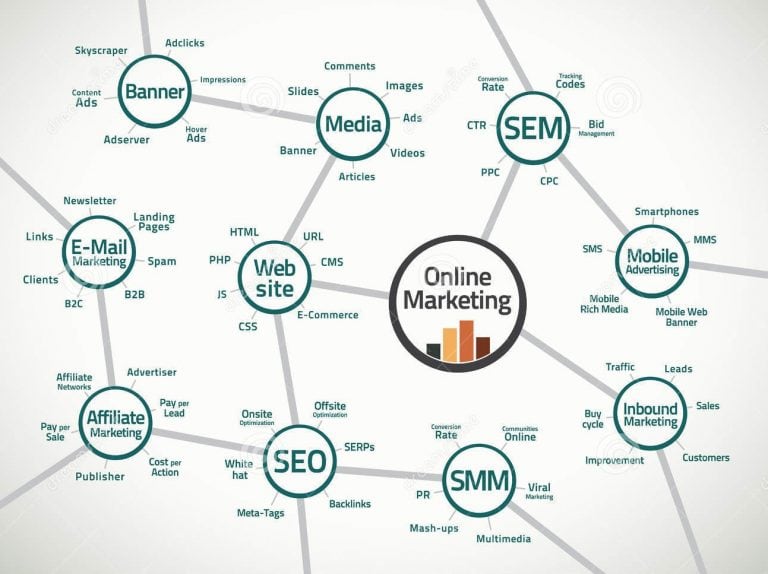

Use Digital Tools to be successful in China’s real estate industry.

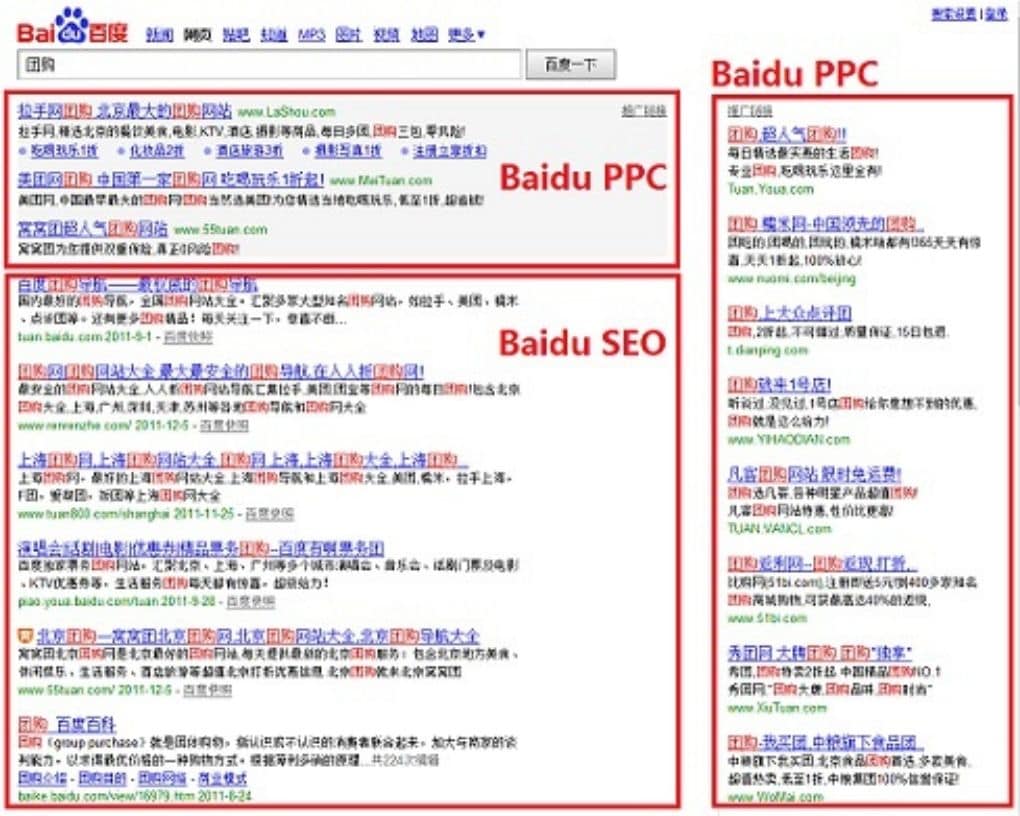

Your real-estate company has to be on the first page of Baidu, China’s no.1 first engine

To consistently create new leads, it is crucial to be on the first page of the Chinese search engine. In China Google doesn’t work. Baidu has replaced it as the most used search engine in China, handling 70 percent of inquiries. If you are not on the first page of these search engines, you will miss over 60 percent of the traffic and, consequently, the opportunity to convert visitors into leads.

SEO – Search Engine Optimization – is required to achieve a high search engine ranking. To do this, you must add relevant and well chosen keywords to attract your leads most effectively. In addition to ensuring that your website’s content is accurate and concise, you should use backlinks to build your confidence index and so boost your website’s rating on various search engines.

The importance of SEM for Foreign Real-Estate Companies in China

Baidu PPC

Baidu ADV is Baidu’s Pay-per-click (PPC) model, in which, if a user searches a keyword into the search engine, the first result is the paid advertisement.

Natural search results will appear at the bottom of the page, while sponsored (paid) results will appear in the top positions. Utilizing PPC is an excellent strategy. Please do not hesitate to contact us so that we may provide you with experienced guidance!

Keywords are an indispensable component of any Digital Marketing strategy. In truth, buyers seek and find what they require through them.

However, frequently the terminology spoken by Chinese speakers are not simple translations. Therefore, a more in-depth examination of the company’s target market and its consumers is required to determine which keywords are most appropriate for the brand in issue.

Focus on your website’s content to attract leads

Optimal content will attract leads. To generate leads, you must be attractive. Thus, the articles on your websites should be well written, without spelling mistakes, and with a coherent structure. This is one of the keys to attracting customers. In the special case of the real estate field, you must be also attractive. So, take care of your articles, take care of your photos, be rigorous in the information you give, and check them carefully and constantly.

We help you with selling real estate properties to Chinese investors

As specialists in the Chinese market with almost 10 years of experience, we basically know all the strategies in order to succeed in China. Over the years, we were able to enhance our services and strategies in the Chinese market.

Excellent program, Really appreciated this social responsible program , since human to human support wants today than yesterday.

Hello,

I am an independant real estate agent and we want to connect with south asian Real estate developers (Thailand, Vietnam)

Contact me via messages, WeChat or Email