UAE Is Becoming A Key Country For Chinese Real Estate Investors

The United Arab Emirates (UAE) real estate market has witnessed significant growth over the past few years, becoming a key player in attracting foreign investment. This impressive growth can be attributed to several aspects such as UAE’s political stability, legal regulations that favor investments, well-developed infrastructure, and its robust economy.

The residential real estate sector stands as the dominant force in the market, projected to reach a substantial market volume of US$0.39 trillion in 2023. This sector is anticipated to exhibit a steady annual growth rate (CAGR 2023-2028) of 2.97%, leading to an estimated market volume of US$0.80 trillion by 2028.

The UAE has been attracting a growing number of Chinese investors in recent years. In fact, Chinese investment has become a key driving force behind the growth and development of the UAE’s real estate market.

From Dubai to Abu Dhabi to other major cities in the region, Chinese buyers are snapping up properties and fueling demand for new developments.

Key Takeaways

- Dubai is a key destination for Chinese investors seeking promising opportunities.

- The primary reasons behind this trend include economic benefits, favorable policies, and the strategic location of the region that presents lucrative returns and ease of entry into new markets for foreign investors.

- Dubai’s attractive visa policies for investors have significantly boosted investor confidence in its thriving real estate market. Investors purchasing a property worth 5 million dirhams or more can apply for long-term residence visas, while retirement visas with no age restrictions are also available to strengthen the government’s strategy to attract foreign investment.

- There are significant prospects and opportunities in both residential and commercial properties within UAE’s real estate landscape for potential Chinese investors seeking diversification outside China’s borders. The ongoing infrastructure projects such as connectivity plans through global economic corridors make it an even more appealing option for real estate investment.

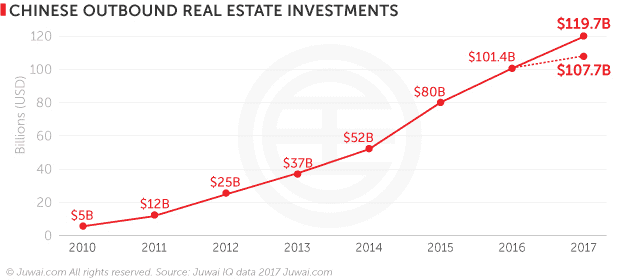

China’s outbound investment highlights a 9.2% increase in overall Overseas Direct Investment (ODI) to US$145.2 billion in 2021 alone – underlining their commitment to exploring new markets such as that of UAE real estate.

The Increasing Role Of Chinese Real Estate Investors

In recent years, the United Arab Emirates has become a key destination for Chinese property buyers seeking promising opportunities. This increasing role of Chinese investors can be associated with various factors such as the Belt and Road Initiative (BRI) and Dubai’s attractive visa policies catered towards foreign business initiatives.

For instance, Chinese investor interest in the Dubai real estate market skyrocketed by 1,200 percent compared to the previous year – an evident indication that Chinese stakeholders are looking beyond their traditional East Asian neighbors when exploring lucrative investment prospects.

The BRI development strategy aims to build connectivity and cooperation across six main economic corridors encompassing the UAE; hence, advancements within these corridors are likely to attract more investments from China.

Despite China having restrictive regulations in certain sectors, their capital inflow into emerging markets like African nations demonstrates a willingness to invest abroad where opportunities present themselves.

Strategic Advantages of Investing in the UAE’s Real Estate

The UAE offers an enticing range of economic benefits that appeal to Chinese investors looking for lucrative returns. For instance, with its quickly growing GDP of $359 billion in 2020 alone, the nation presents significant opportunities in the real estate market.

Moreover, being strategically located between Europe and Asia has made the UAE a regional hub for business expansion and international cooperation.

In addition to these advantages, government policies play a pivotal role in fostering this upward investment pattern from China. One example is the introduction of business-friendly free zones within Dubai that provide tax incentives and relaxed regulations on foreign ownership – matters highly relevant for Chinese investors seeking ease of entry into new markets like those found in the iconic city of Dubai or other parts of the Gulf Area.

Case Studies: Successful Chinese Real Estate Investments in UAE

- In 2014, China State Construction Engineering Corporation (CSCEC) won a $680 million contract to build the UAE’s tallest tower, the 1,000-meter-high Dubai Creek Tower. The project was supposed to be completed in 2022, but it was delayed due to the pandemic.

- In 2018, Chinese property developer Greenland Group announced plans to construct an $870 million skyscraper in Dubai’s business district. The project, called “Azure” will comprise luxury apartments, hotels, and retail spaces.

- In 2019, Abu Dhabi Investment Authority (ADIA), one of the world’s largest sovereign wealth funds, acquired a 42% stake in Raffles City Chongqing, China for around $1.15 billion. Raffles City Chongqing is being built by Singaporean developer CapitaLand and partner Ascendas-Singbridge.

Dubai As A Key City Attracting Chinese Investment

Dubai’s visa policies represent a key attraction for foreign investors, particularly those interested in the real estate market. Investors purchasing a property worth 5 million dirhams or more can apply for long-term residence visas, allowing them to stay in the country for up to five years.

This is an excellent incentive and one of the reasons why Dubai has become such a popular destination for overseas investors, including Chinese buyers. Furthermore, Dubai offers retirement visas with no age restrictions as well as six-month multiple entry visit visas obtainable by paying just AED 2,000 ($544).

These policies are part of the government’s strategy to attract foreign investment and strengthen its economy by providing incentives that align with global investor needs.

Dubai is renowned for its luxury real estate market and favorable investment policies, making it an attractive destination for foreign investors. Additionally, Dubai’s infrastructure development initiatives have enhanced its appeal to Chinese investors seeking opportunities beyond traditional residential properties.

For instance, there are several commercial and mixed-use developments currently underway that offer significant potential for long-term returns on investment.

Infrastructure And Developments Attractive To Chinese Investors

Connectivity is a key feature that draws Chinese investors to the country’s real estate market, particularly Dubai. The Belt and Road Initiative development strategy aims to build connectivity and cooperation across six main economic corridors, including Dubai and the UAE.

Some of the most notable examples include Dubai’s World Expo 2020 site which has attracted significant investment from China Construction Engineering Corporation (CCECC). The project involves developing infrastructure for hosting events with up-to-date technology alongside retail outlets, offices, residential areas as well as an energy center.

Investments in these projects offer many benefits such as increased productivity through improved transport links while creating job opportunities within the industry or supply chain networks of these large-scale construction projects; hence it’s easy to see why they’re so attractive to foreign investors.

Benefits Of Chinese Investment In UAE Real Estate

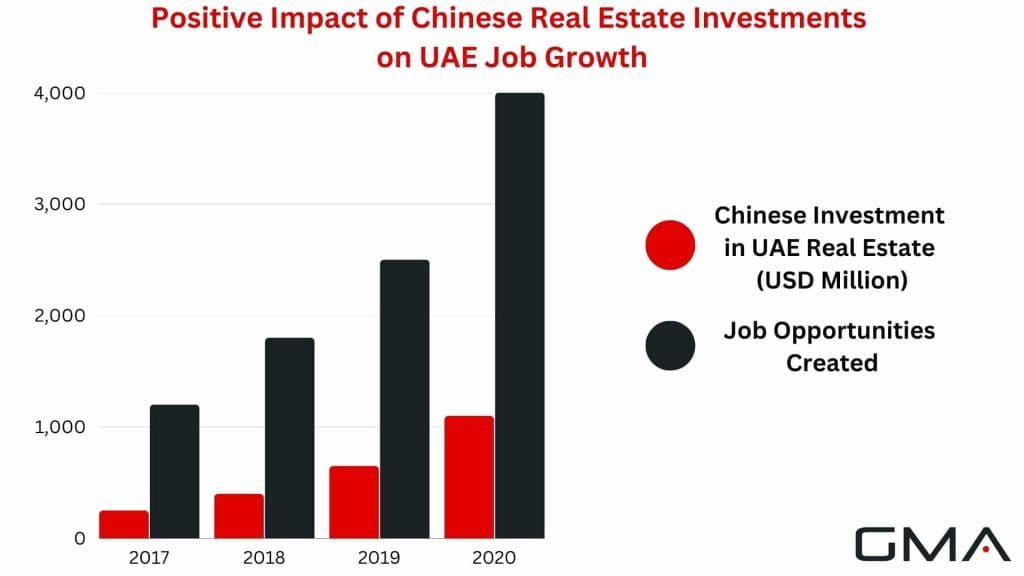

One significant advantage of Chinese investment in the UAE real estate sector is the creation of job opportunities, as evidenced by the employment statistics following major Chinese investments. The following table demonstrates the positive impact on job growth in the UAE as a direct result of Chinese investments in real estate projects:

As shown in the table, increasing levels of Chinese investment in the UAE real estate market have corresponded with a considerable rise in job opportunities. This trend is expected to continue, as China remains committed to its Belt and Road Initiative, which aims to build connectivity and cooperation across six main economic corridors, including the UAE real estate sector.

Increased capital inflow from investors in China not only creates job opportunities, but also contributes to the growth of various sectors such as tourism and hospitality, retail, and construction.

For example, recent successful investments by Chinese businesses include Emaar Properties partnering with Beijing Daxing International Airport to develop an $11 billion project spanning 5 square kilometers. This will create over 2000 jobs and attract millions of tourists once completed.

Chinese investment in UAE real estate is driving significant infrastructure improvement with new projects and construction advancements too.

Digital technologies such as 5G networks, automation, robotics, and artificial intelligence are being leveraged to build smart factories in the region. These technologies have not only improved construction practices but also created opportunities for job creation.

Challenges And Solutions For Chinese Investment In UAE Real Estate

Wealthy Chinese investors may face cultural and regulatory hurdles. For example, there could be differences in business practices or language barriers that can impact negotiations and transactions.

Additionally, there are certain regulations governing property ownership and foreign investment that may differ from those in China. To overcome these challenges, policymakers are exploring solutions such as changes to visa rules for those living abroad or partnering with local companies who understand the legal landscape of investing in UAE realty.

It’s worth noting that existing payment channels between Chinese buyers and UAE developers have not faced significant issues so far. While strict quarantine rules preventing investors from visiting to inspect properties may have been a challenge during the pandemic, technological advancements such as virtual tours have helped mitigate this issue to some extent.

Although there are a few hurdles to overcome, there are also some practical solutions that can be implemented to overcome these challenges. Here are a few strategies:

- Build strong relationships with local partners: This is crucial to understanding the market and navigating cultural differences.

- Seek guidance from industry experts: Working with local real estate firms and lawyers can help streamline legal procedures and provide valuable insight into the market.

- Conduct thorough market research: This helps investors evaluate potential investments while also minimizing risks.

- Consider forming joint ventures: Partnering with local businesses or individuals can help mitigate language barriers and bridge cultural gaps.

- Focus on due diligence: It’s essential for potential investors to obtain all necessary permits, licenses, and approvals before proceeding with any investment.

Future Prospects Of Chinese Investment In UAE Real Estate

As we look toward the future of Chinese investment in UAE real estate, there is great potential for sustained growth and expansion. According to recent reports, the construction industry in UAE is expected to grow by 3.3% this year alone.

One key trend to watch is workforce transformation. With technology advancements and changing work environments, flexible spaces are becoming increasingly popular among employees who value quality of life.

Another area for potential growth lies in affordable housing solutions as migration continues to drive demand up for cost-effective living options across markets such as Abu Dhabi or Dubai where rental rates are high.

Maintaining and strengthening relationships with Chinese real estate investors is crucial to the continued growth of the UAE’s economy. One strategy to achieve this is by promoting economic cooperation through bilateral trade agreements.

Another approach could be aimed at creating a more investor-friendly environment that caters to their needs while also providing them with incentives or tax breaks as they explore new business opportunities.

As the relationship between UAE and China continues to strengthen, it will remain vital that both parties invest in each other’s future success by fostering mutual growth opportunities through increased communication, dialogue, and collaboration across various industries.

The Broader Impact Of Chinese Investment

Chinese investment in overseas property has a significant impact on Sino-UAE relations. As China continues to invest heavily in the country, there is strong potential for strengthened economic and political ties between both nations.

This could translate to increased collaboration, growth of trade and investments, as well as higher levels of cooperation across sectors such as infrastructure development.

As Chinese investment in UAE real estate continues to grow, it is worth considering the impact this has on other foreign investors in the sector.

For instance, successful Chinese investments such as City Walk and Blue Water Island have attracted attention from investors across Asia and Europe. This goes to show that a strong Chinese investor presence can actually generate wider interest in UAE property markets, leading to increased economic activity, employment opportunities, and infrastructure development for all stakeholders involved.

Building Bridges: The Power of UAE-China Real Estate Collaborations

Chinese investment in UAE real estate has emerged as a pivotal driver behind the country’s remarkable growth and development. As we acknowledge the immense potential that lies within an increased collaboration between UAE and Chinese stakeholders, it becomes crucial to identify and maximize the benefits derived from this partnership.

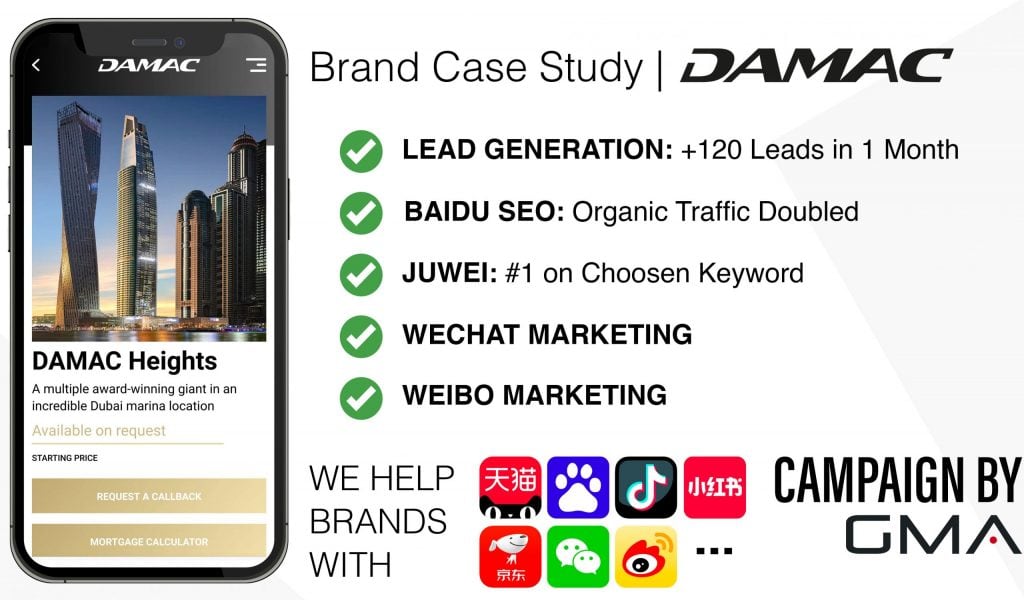

The real estate sector, in particular, presents a multitude of opportunities for both nations to achieve mutual growth and profitability. At our agency, we understand the significance of fostering positive investment climates and overcoming cultural and regulatory obstacles faced by investors from both sides. We are here to provide our expertise and support, ensuring seamless cooperation and facilitating successful real estate ventures between UAE and Chinese investors.

Through the establishment of bilateral agreements and the cultivation of strategic trade relations, we can harness the power of global investment flows and further enhance infrastructure development. Our agency stands ready to assist and guide you in navigating the cultural nuances and regulatory challenges, ultimately paving the way for prosperous investments in UAE real estate.

Contact us today, and together we can unlock the full potential of Chinese investment in UAE real estate, fostering lasting growth and strengthening the partnership between our nations.