More Chinese second-tier cities are expected to travel to international destinations

China provides more and more travellers: it is estimated that more than 200 million trips will be taken by Chinese tourists in 2015. It also seems that the profile of Chinese tourists is slowly changing. According to China Outbound Tourism Research Institute (COTRI), we should expect more travellers coming from second- and third- tier cities.

What are first-, second- and third-tier cities?

In its “Market Report”, COTRI provides a definition of these 3 city profiles. First-tier cities are the biggest ones in China: Shanghai, Beijing, Guangzhou and Shenzhen. Then the cities of Nanjing, Wuhan, Xi’an, Chongqing, Chengdu, Suzhou, Xiamen, Qingdao, Tianjin, Xangzhou, Xiamen and Dongguan are listed are second-tier ones. Other cities are classified as third-tier.

Where are these second-tier travellers flying to?

Second-tier travellers obviously go to Asian destinations but new destinations are emerging for these tourists such as Australia, the USA and cities in Europe.

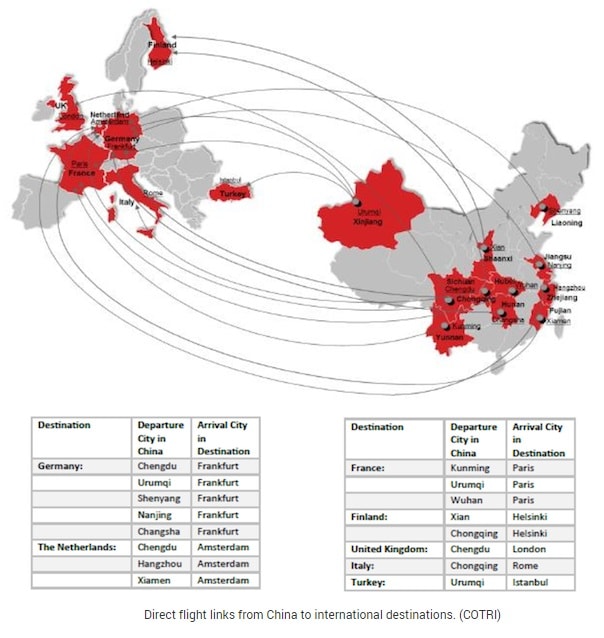

This increasing number of international travellers from second-tier cities is due to the opening of direct flights from these cities. Most of these flights take off in Chengdu, Urumqi or Chongqing. However, flights are still limited and until more direct flights are available, the existing outbound destinations will serve as centers for these Chinese travellers.

As you can see on the chart below, most of the existing connections land in the same European cities.

What are second-tier tourists’ favourite destination?

COTRI states that France is the favourite destination for travellers from second-tier cities in China. This is not surprising since it has been on Chinese tourists’ travel wish list for years. And it seems France is getting more and more attention from Chinese travellers: Ctrip – one of the biggest Chinese online tourism company – has registered three times more bookings for France during the Golden Week in 2015 than in 2014.

However, it appears that more travellers from second-tiers cities choose France as a destination: while these travellers account for 40%, only 31% of all Chinese travellers to France come from China’s four biggest cities.

Asian destinations for second-tier travellers

source COTRI

Southeast Asia

Popular destinations within Asia are Thailand and Malaysia. The same phenomenon happens for these destinations: they attract a higher number of travellers from second- and third- cities than people from first-tier cities. Even if China has the most direct flights from second-tier cities to Southeast Asia, it appears these countries are bringing less Chinese tourists than they used to. Indeed, excluding Thailand, there were 200,000 less Chinese tourist arrivals in Southeast Asia in 2014 than in 2013, the total number dropping to 6.2 million.

Hong Kong and Macau

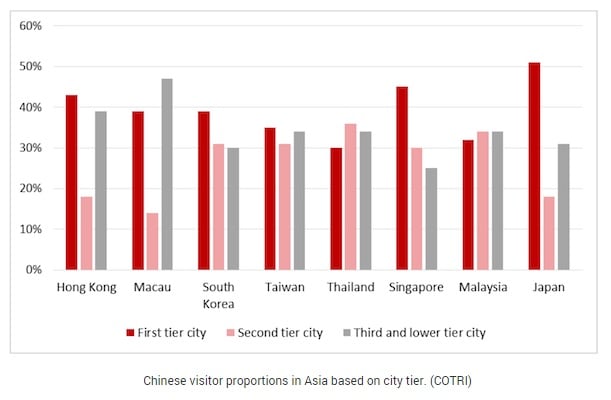

We can also spot some emerging patterns regarding trips to Hong Kong and Macau, which do not attract many second-tier travellers.

Parallel to the decreasing number of Chinese tourists in Hong Kong, we can now observe a gap between these tourist categories: while first- and third travellers each account for 40% of mainland travellers in Hong Kong, second-tier travellers only represent 20% of them.

The same happens in Macau, where second-tier Chinese travellers account for about 15%, first-tier ones for nearly 40% and third-tier ones for more than 45%.

Northeast Asia

South Korea and Japan are popular destinations for first-tier visitors, which can be explained by the high number of flights taking off from Shanghai.

But we can see an increasing number of travellers from second- and third-tier cities too: there are 29 of these direct flights which head to South Korea, and 21 to Japan.

What are the consequences of these emerging trends?

COTRI predicts that the number of Chinese international tourists will keep on increasing, especially thanks to these second- and third-cities travellers. Consequently, it means new potential for hoteliers and brands around the world and the latter should adapt to these new customers’ needs if they want to profit from this opportunity.

Further readings :