Douyin sales more than triple in China

Douyin announced that its online sales have more than tripled

The Chinese edition of TikTok, Douyin, has announced that its online sales have more than tripled in the year to April. This is a remarkable growth rate for an e-commerce startup at a time when the majors in China are slowing down.

Chinese short video platforms such as Douyin and Kuaishou, backed by ByteDance, are rapidly eroding the market share of e-commerce giants Alibaba, JD, and Pinduoduo with their popular social content.

Douyin announced its sales figures and growth plans at China’s 618 shopping festival to build momentum for the mid-year spending spree.

Douyin’s gross product value (GMV) jumped 320% year-on-year in April, with the company selling more than 10 billion products. Wei Wenwen, president of Douyin Electronic Commerce, said in Chinese at a conference on Douyin’s e-commerce.

Douyin and its “full-field interest e-commerce

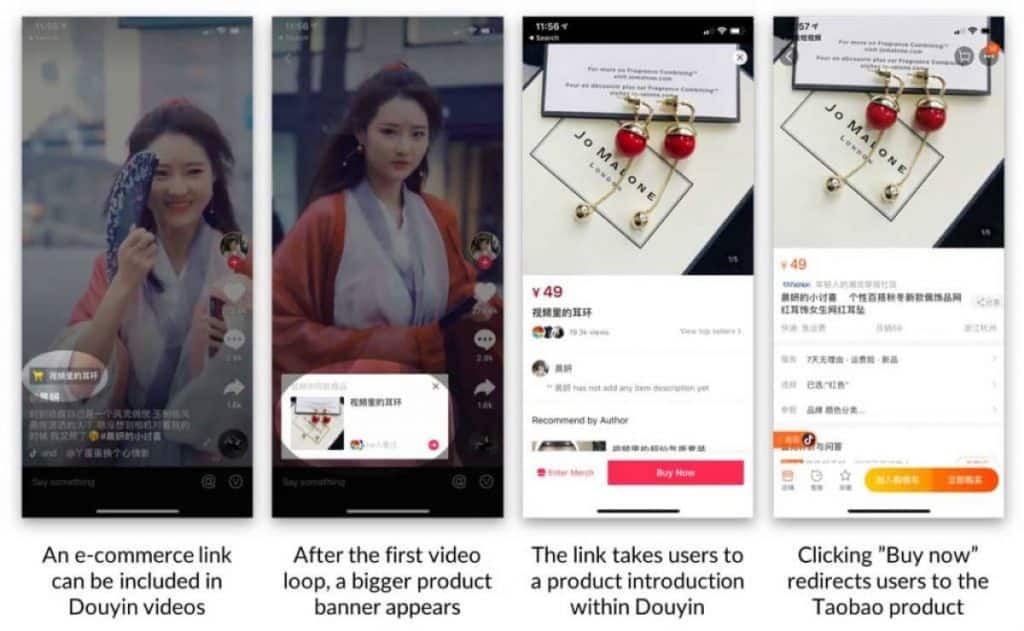

Douyin, which was launched last April as “interest e-commerce”, was renamed at the online meeting as “full-field interest e-commerce”. Wei said the company hoped to demonstrate its ability to attract customers through several channels, including short videos, live streaming, and its search function.

Although the company did not give a GMV figure, Caixin said Douyin had more than RMB 800 billion in GMV by 2021. Douyin is expected to earn between RMB 1,000 and 1,200 billion this year. Caixin replied that this figure was incorrect.

Douyin’s growth in China

Douyin Ecommerce was established as a separate business unit two years ago. It has grown rapidly thanks to Douyin’s 600,000,000 daily active users. Douyin produces more than 200,000,000 short videos per month and has 9 million Livestream sessions per month to convert users’ attention into sales.

Douyin’s Wei said she believes there is still a lot of potential in the sector, and that the platform plans to capture more than half of the industry’s future growth market.

Background Despite their dominant market position, Alibaba, JD, and Pinduoduo are experiencing slowing growth due to macroeconomic headwinds and regulatory challenges.

Alibaba’s global consumer-focused business generated RMB 8.3 trillion in GMV in the year to March. This is relatively stable compared to RMB 8.1 trillion a year ago. Pinduoduo’s GMV increased by 46% to RMB 2.34 trillion in 2021. JD’s GMV increased by 26.2% over the same period. Kuaishou’s GMV increased by 78.4% per year to RMB 680 billion in 2021.

Douyin’s e-commerce sales were higher than its brother TikTok, which would have reached nearly RMB 6 billion in GMV in 2021.